Leaders of the largest beef, pork, and poultry processing companies recently warned that the COVID-19 pandemic has threatened critical supply chains, disrupting the meat supply and leaving wasted food and empty grocery store shelves in its wake. The Chairman of the Board of Tyson Foods, one of the largest meat processors in the U.S., even took a full page ad in the New York Times to warn of the perils of collapse.[1] This was followed by President Trump’s invocation of the Defense Production Act to force meat processing plants to stay open to ensure supply during the public health crisis.[2]

The integrity and stability of the food system is a matter of national health, safety, and security. Disruption of the meat or any other food supply chain is potentially catastrophic. But few analysts have looked beyond the immediate COVID-19 pandemic to isolate one of the deep-rooted causes of weakness, or even breakage, in supply chains. Were our food processing, manufacturing, and distribution markets more competitive, the current crisis (and government intervention) would be neither necessary nor warranted. Much like AAI’s recent commentary on COVID-19 and consolidation in medical equipment markets, this commentary explains how a lack of competition can imperil the stability and security of the food system.[3]

The Role of Competition in Ensuring Stable, Resilient Food Supply Chains

COVID-19-related disruptions are, in part, a symptom of underlying competition problems in our food system, and an early warning sign of the harms yet to come. Competition benefits consumers and producers in myriad ways. These include fair prices, high quality products and services, and incentives to innovate. Another key benefit of competition is promoting diversity and redundancy in sources of agricultural inputs, processing, manufacturing, and distribution. This promotes resiliency and stability in the interconnected markets that form the food system.

Supply chains are routinely subjected to shocks such as extreme weather, disease, and conflict.[4] But those that feature robust competition at various levels are far more likely to ensure the reliable and stable distribution of essential food products. If some parts of the supply chain are disrupted, competition works to ensure that rival suppliers fill the void to meet demand.

As the COVID-19 pandemic illustrates, food supply chains can fail the “resiliency” test. While a number of factors may account for this, we cannot ignore the role played by the wave of consolidation that has fundamentally reshaped the food system in the U.S. over the last two decades. Consolidation has diminished competition in the agricultural inputs, processing, manufacturing, and distribution segments. As the closures of meat processing plants demonstrate, when the few large firms that control these critical segments fail, the supply chain can break.

Unpacking the Competition “Bottleneck” in the Food Supply Chain

There are any number of incentives for merger—both pro-competitive and anticompetitive. But in food, two are particularly problematic. One is the incentive to “bulk up” to gain bargaining power vis-à-vis customers and suppliers. Powerful beef, pork, and poultry processors can drive down prices paid to ranchers and growers. And big grocery chains can bargain more effectively with powerful food processors and manufacturers. These incentives have created a domino-like effect of consolidation along the food supply chain, resulting dominant firms or oligopolies in processing, manufacturing, and retail grocery.[5]

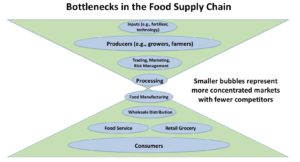

The graphic below illustrates the bottlenecks that result from a lack of competition. For example, the four largest firms (Tyson Foods, JBS SA, Cargill, and National Beef Packing Co.) control over 80% of the national beef packing market.[6] Two firms (JBS SA and Tyson) control over a third of the broader national meat processing market.[7] When markets are concentrated, the failure of one supplier means few are left to take up the slack, imperiling the entire system.

A second incentive for consolidation is for firms to integrate horizontally and vertically to expand and solidify economic control over multiple markets in the supply chain. The results are enhanced market power and stronger incentives to exclude smaller rivals, or to coordinate with other large rivals in fixing prices or dividing up markets. For example, the major beef packers have begun to integrate upstream into cattle supply and ownership of feedlots, increasing incentives to exclude independent cattle producers.[8] Producers and consumers suffer directly from these effects.

Merger control is designed to prevent acquisitions that are likely to substantially lessen competition. This includes acquisitions of head-to-head rivals; customers or suppliers; and potential rivals. Vigorous enforcement prevents harmful outcomes by stopping illegal mergers in their “incipiency.” The U.S. antitrust agencies have historically divided up the food supply chain for the purposes of reviewing food and agriculture mergers. The Federal Trade Commission (FTC) reviews most proposed transactions involving the downstream part of the supply chain, including food manufacturing and retail grocery.[9]

The U.S. Department of Justice (DOJ) reviews mergers in the upper part of the supply chain, such as food processing (e.g., grain milling and meat packing), producers (e.g., cattle feeders and chicken growers), and biotechnology inputs such as GMO traits, seeds, and agrochemicals. It is not clear how the FTC and DOJ coordinate with each other in reviewing mergers along the supply chain, so that the proverbial “right hand knows what the left hand is doing.”

Is Merger Enforcement Keeping Up with Consolidation in Food?

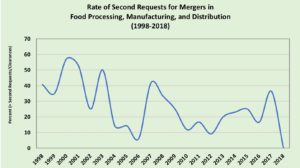

Between 1998 and 2018, almost 1,300 mergers in the processing, manufacturing, and food distribution sectors were reportable to the U.S. antitrust agencies under federal guidelines.[10] Government data reveals that about one-quarter of those transactions were cleared to either the DOJ or FTC for further review. About one-quarter of those “clearances,” in turn, received a request from either agency for additional information. This is a slightly higher rate of “Second Requests” for food mergers, as measured by the percentage of total clearances that received a Second Request, than for mergers across all sectors in the economy. The majority of these deals involved consolidation in the middle part of the supply chain—food processing and manufacturing.

Only a small fraction of the food mergers that were cleared to the DOJ and FTC between 1998 and 2018 were actually challenged by the government. Merger challenges can result in a number of outcomes: successfully enjoining a merger, unsuccessfully enjoining a merger (which then proceeds), forced abandonment of a transaction, and an order containing requirements to remedy competitive harms raised by a deal. The rate at which the government challenged food mergers, as measured by the percentage of total clearances that were challenged, is just below the average across all sectors. More than one-half of the merger deals that were challenged by the agencies were in the retail grocery segment where significant competition has been eliminated over time. The remainder include mergers in beef packing, poultry processing, and dairy, other food products, and broadline foodservice distribution.

Two major government wins were the DOJ’s successful challenge to the merger of two of the largest beef packers (JBS and National Beef) in 2009 and the FTC’s move to block the merger of the two largest broadline food distributors (Sysco and US Foods) in 2015.[11] U.S. consumers and producers need more of this type of aggressive, successful enforcement. But a major failure was the FTC’s approval of the merger of Safeway and Albertsons. The merger was allowed to proceed, subject to the divestiture of almost 150 stores to a regional west-coast grocer, Haggen. The failure of Haggen to maintain the divested stores led to their shuttering only a few months later.[12] In 2019, the DOJ declined to challenge the acquisition of Iowa Premium by one of the largest packers, National Beef, a deal that was opposed by numerous advocacy groups. The merger was projected to adversely affect the important cash market, which determines the base price for cattle sold on contracts or formulas.[13]

As shown in the figure below, over the last 20 years, the intensity with which the agencies have looked harder at food mergers through the Second Request process appears to have waned. The apparent downward trend in Second Requests over the past two decades is troubling. It may signal chronic resource constraints at the agencies. But it also likely reflects the view that has dominated enforcement for the last four decades. Namely, most deals are viewed as pro-competitive because cost-savings and consumer benefits are claimed to outweigh any anticompetitive, harmful effects.

Regardless of the reason, U.S. consumers are still faced with a swath of mergers that have created larger integrated companies that reach to almost every part of the supply chain. These food goliaths can exercise their market power to suppress competition, which is problematic in its own right. But as the COVID-19 crisis has demonstrated, the lack of competition in food processing, manufacturing, and distribution has also created a fragile and unreliable supply chain.

Policing Anticompetitive Conduct in the Food System

It should come as no surprise that in a supply chain with less and less competition, other violations of the antitrust laws, including collusion and monopolization, become more commonplace. Indeed, the dominant firms and oligopolies in food processing, manufacturing, and grocery have given rise to numerous concerns. The public and private antitrust cases in the food industry in recent years reflect both the rising incidence of troubling behavior and the challenges and limitations of antitrust enforcement.

The DOJ, for example, has prosecuted violations of Sections 1 and 2 of the Sherman Act in almost 20 cases in the food industry over the last 20 years. Notably, however, the Sherman Act claims appeared to be an afterthought in the majority of these cases, which were motivated principally by kickback schemes that defrauded the public. Competitive injury, and core antitrust concerns such as collusion or exclusionary conduct, did not feature prominently.[14] Smithfield, one of the largest pork processors in the U.S., which was acquired by the Chinese food behemoth Shuanghui International in 2013, was charged with violations on two separate occasions involving failure to comply with requirements under the Hart Scott Rodino Act before purchasing stock in a rival and pursuing an acquisition.[15] DOJ has launched several cartel investigations in food over the last two decades, but, with few exceptions, those investigations have yet to yield indictments or civil complaints.[16]

But where public enforcement cannot keep up with potential violations, private antitrust enforcement can provide needed support. A strong indication of the degree to which anticompetitive conditions have been allowed to develop in the food supply chain is the sheer volume of private litigation recently aimed at food processors and manufacturers.[17] In the last decade, private antitrust suits have been filed against processors and producers in seemingly every major food product: beef; chicken; turkey; pork; tuna; farmed salmon; milk; eggs; potatoes; and mushrooms.[18]

Private cases have also been brought against the shrinking pool of competitors in the grocery market.[19] Some of these litigations follow on government investigations or enforcement actions, but many were initiated by private plaintiffs with government scrutiny sometimes following. These private litigations do supplement and reinforce government investigations and actions, but their impact has been limited by several factors hampering private antitrust actions generally, as well as some issues particular to antitrust class actions in the food industry.

The challenges facing Private Enforcement of the antitrust laws

One major factor hampering private enforcement is that federal courts have been steadily increasing the burden on plaintiffs pleading antitrust conspiracies to establish that the defendants’ conduct results from collusion and not from un-coordinated, but consciously parallel, conduct among competitors. This has, ironically, meant that it is more difficult for plaintiffs to successfully allege collusion where industries are highly concentrated, because where there are only a few competitors, they do not need to actually collude in order to achieve supracompetitive prices.

A leading example is a Minnesota district court’s August 2019 decision to dismiss conspiracy claims brought by purchasers against the nation’s major pork producers.[20] Despite “strong” allegations that the dominant pork producers cut supply in the face of increasing demand for pork products, and statements from the defendants that they had spoken with one another and discussed the need to cut production to fix the industry, the court held the complaint failed to sufficiently allege a conspiracy. In the absence of a “smoking gun,” the court found plaintiffs’ other allegations insufficient, because they did not include enough specific detail about the conduct of each defendant to distinguish consciously parallel conduct from conspiracy.

A second factor that hampers private antitrust actions is class certification. Obtaining certification of a class has become increasingly difficult over the last several decades and presents a considerable barrier to private antitrust litigation. Because a named plaintiff in a class action is allowed to represent the interests of the entire class of plaintiffs, not just those that are actively participating in the litigation, procedural rules require that courts certify that proposed class actions and class representatives meet certain criteria before proceeding.

The rules governing class certification have changed little over this time period. However, courts’ interpretations of them have become increasingly demanding to the point where obtaining certification of a class requires that a plaintiff, effectively, prove a large portion of his or her case at this preliminary stage. Certifying a class can be a significant barrier to litigation, even when evidence of wrongdoing is overwhelming. Ongoing private litigation over admitted price fixing by the three dominant players in the canned seafood industry presents a prime example.

In 2015, it was revealed that Chicken of the Sea had approached the DOJ to seek “leniency” for its part in a price fixing conspiracy with its only two significant competitors in the canned tuna industry (Bumble Bee and StarKist). Multiple private litigations followed. Bumble Bee and StarKist subsequently pled guilty to the scheme. In July of 2019, the district court certified three separate classes of buyers—end payers, direct purchasers and commercial food preparers—clearing the way for the private cases to proceed as class actions. But in December, the Ninth Circuit granted the defendants’ motion to appeal from the district court’s certification order, delaying and potentially upending the private litigation.[21]

A third factor is that government investigations that overlap private suits can ultimately aid private plaintiffs, but the primacy of the government’s “interest” can significantly impair the ability of private plaintiffs to effectively litigate their claims. For example, in June of 2019, the DOJ revealed its investigation into anticompetitive conduct in the chicken industry. At the same time, DOJ asked the court in an ongoing private antitrust case brought by chicken farmers and chicken purchasers against chicken producers alleging a collusive scheme to manipulate chicken prices to stay that litigation to allow the DOJ investigation to proceed. The court agreed to partially stay the private litigation.[22] While various groups of plaintiffs have reached settlements with select defendants and some discovery has occurred, the overall resolution of the case is currently on hold indefinitely.

Finally, a major challenge facing consumer class actions in the food industry is identifying which consumers were harmed and by what amount. This issue is not unique to the food industry, but it is particularly acute in consumer class actions concerning overcharges for grocery items. Consumers do not keep good records of their individual food purchases, and while stores have records of sales, they are generally not traceable to particular consumers. Defendants have exploited this fact to prevent certification of consumer classes in multiple food cases.[23]

Where Do We Go From Here?

The food industry has undergone sweeping consolidation in the last two decades, leading to multiple highly concentrated markets and vertically-integrated companies. The result has been food markets that are less diverse, less resilient, and less competitive. Such markets are also more prone to anticompetitive conduct and outright collusion. At the same time, courts have made it more and more difficult for the agencies and private plaintiffs to combat anticompetitive conduct and collusion by increasingly strict interpretations of procedural rules and substantive antitrust law.

The recent surge of private antitrust litigation in the food industry highlights the scope of the problem. But these cases also illuminate the challenges and limitations of bringing lawsuits to combat anticompetitive conduct after it has occurred, instead of preventing the conditions for that conduct from developing in the first place. Despite these challenges, private antitrust enforcement has achieved significant victories against food producers.[24] These successes, hard fought and incomplete, cannot alone counter the anticompetitive forces in these industries or unwind the decades of consolidation that have led us to this point.

In light of sweeping consolidation in the food supply chain, and the instability that it has created, it is likely that other COVID-19-like shocks will further demonstrate that they are symptomatic of a lack of rigorous antitrust enforcement. The lack of resiliency in supply chains such as food, healthcare, and others demonstrates just some of the public policy problems that lax enforcement poses. Solutions to these problems include stronger antitrust enforcement, but also other tools for addressing demonstrated harms to consumers, workers, and businesses from consummated mergers. This will require public policy solutions, including legislative approaches to clarify and strengthen the antitrust laws, to better combat threats to competition and promote the welfare of consumers and workers.

Notes

[1] Sanya Mansoor, ‘The Food Supply Chain Is Breaking.’ Tyson Foods Warns of Meat Shortage as Plants Close Due to COVID-19 (Apr. 26, 2020), available at https://time.com/5827631/tyson-foods-meat-shortage/.

[2] Taylor Telford, Kimberly Kindy and Jacob Bogage, Trump orders meat plants to stay open in pandemic (Apr. 29, 2020), available at https://www.washingtonpost.com/business/2020/04/28/trump-meat-plants-dpa/.

[3] Diana L. Moss, Can Competition Save Lives? The Intersection of COVID-19, Ventilators, and Antitrust Enforcement, American Antitrust Institute (Mar. 31, 2020), available at https://www.antitrustinstitute.org/work-product/can-competition-save-lives-the-intersection-of-covid-19-ventilators-and-antitrust-enforcement/

[4] Diana L. Moss and C. Robert Taylor, Short Ends of the Stick: The Plight of Growers and Consumers in Concentrated Agricultural Supply Chains, 2014 Wis. L. Rev. 337 (2014).

[5] See, e.g., American Antitrust Institute, Letter to FTC Chairwoman Edith Ramirez re: Proposed Merger of Sysco and US Foods (Feb. 25, 2014), available at https://www.antitrustinstitute.org/wp-content/uploads/2014/02/AAISyscoUSFoodsMergerLetter_0.pdf.

[6] U.S. Department of Agriculture, Agricultural Marketing Service, Packers and Stockyards Division, Annual Report 2018, at Table 5, available at https://www.ams.usda.gov/sites/default/files/media/PSDAnnualReport2018.pdf. Data are for steers and heifers.

[7] U.S. Government Accountability Office, Structure of U.S. Cattle Markets, Report: GAO-18-296 (Apr. 2018), available at https://www.gao.gov/assets/700/691178.pdf; and 2019 Top 100 Meat & Poultry Processors, Provisioneronline.com, available at https://www.provisioneronline.com/2019-top-100-meat-and-poultry-processors.

[8] Food and Water Watch, Horizontal Consolidation and Buyer Power in the Beef Industry (Jul. 2010), available at https://www.foodandwaterwatch.org/sites/default/files/beefconcentration.pdf.

[9] The FTC also reviews mergers relating to agricultural inputs such as fertilizers.

[10] Annual Reports to Congress Pursuant to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, 1998 through 2018, available at https://www.ftc.gov/policy/reports/policy-reports/annual-competition-reports.

[11] Complaint, U.S., et al vs. JBS SA and National Beef Packing Co. LLC, Case No. 08CV5992 (N.D. Ill., Oct. 20, 2008); and Complaint, Federal Trade Commission, et al, v. Sysco Corporation and USF Holding Corp. and US Foods, Inc., Case No.1:15-cv-00256-APM (D.C.C., Feb. 20, 2015).

[12] Press Release, Fed. Trade Comm’n, FTC Requires Albertsons and Safeway to Sell 168 Stores as a Condition of Merger (Jan. 27, 2015), https://www.ftc.gov/news-events/press-releases/2015/01/ftc-requires-albertsons-safeway-sell-168-stores-condition-merger; Brent Kendall, Haggen Struggles After Trying to Digest Albertsons Stores, WALL ST. J. (Oct. 9, 2015), available at http://www.wsj.com/articles/haggen-struggles-after-trying-to-digest-albertsons-stores-1444410394.

[13] Claire Kelloway, Beef Packing Merger Threatens America’s Last Competitive Cash Cattle Market, FoodandPower.net (Apr. 11, 2019), available at http://www.foodandpower.net/2019/04/11/beef-packing-merger-threatens-americas-last-competitive-cash-cattle-market/.

[14] In fact, despite widespread allegations of anticompetitive conduct among manufacturers and processors, the only price fixing case in food prosecuted by DOJ under the Sherman Act during this time period is the tuna case, which was brought to DOJ by a leniency applicant. See “Tri-Union Admits To Blowing the Whistle in DOJ Tuna Probe,” Law360 (Sept. 11, 2017). The only other major Section 1 case in this tally is the one against mushroom growers, which was based on exclusionary conduct by an agricultural cooperative organized under the Capper-Volstead Act. See Complaint, U.S. v. Eastern Mushroom Marketing Coop, Inc., 2:04-cv-5829 (E.D. Pa. Dec. 16, 2004).

[15] Complaint, U.S. vs. Smithfield Foods, Inc. and Premium Standard Farms, LLC, Case: 1:10-cv-00120 (D.D.C, Jan. 21, 2010); and Complaint, U.S. v. Smithfield Foods, Case 1:03CV00434 (HHK) (Feb. 28, 2003).

[16] Notable examples include chicken broilers, discussed in the following section, and farmed salmon. https://www.law360.com/articles/1220417/atlantic-salmon-farmers-snagged-in-us-cartel-probe.

[17] See, generally, Scott Wagner & Lori Lustrin, “’Big Food’ Takes Its Turn In The Price-Fixing Spotlight, Law360 (April 30, 2019).

[18] In re: Cattle Antitrust Litig., 0:19-cv-01222 (D. Minn.); Peterson et al. v. Agri Stats, Inc. et al., 0:19-cv-0119 (D. Minn.) (beef); In re Pork Antitrust Litig., 0:18-cv-01776 (D. Minn.); In re Broiler Chicken Antitrust Litig., 1:16-cv-08637 (N.D. Ill.); Sandee’s Catering v. Agri Stats, Inc. et al., 1:20-c-02295 (N.D. Ill.) (turkey); Olean Wholesale Grocery Cooperative et al. v. Agri Stats, Inc. et al., 1:19-cv-08318 (N.D. Ill.) (turkey); In re: Packaged Seafood Prods. Antitrust Litig., 3:15-md-02670 (S.D. Cal.) (tuna); In re: Farm-Raised Salmon and Salmon Prods. Litig., 1:19-cv-21551 (S.D. Fla.); In re: Processed Egg Products Antitrust Litig., 2:08-md-020002 (E.D. Pa.); In re: Mushroom Direct Purchaser Antitrust Litig., 2:06-cv-00620 (E.D. Pa.); First Impressions Salon, Inc. v. Nat’l Mike Producers Federation, et al., 3:13-cv-00454 (S.D. Ill.) (milk); Carlin et al. v. DairyAmerica, Inc., et al., 1:09-cv-00430 (E.D. Cal.) (milk); In re: Fresh and Process Potatoes Antitrust Litig., 4:10-md-02186 (D. Idaho); In re Mushroom Direct Purchaser Antitrust Litig., 2:06-cv-00620 (E.D. Pa.).

[19] One notable addition to the grocery market, whose competitive impact remains to be seen, is Amazon through its 2017 purchase of Whole Foods. See Statement of Federal Trade Commission’s Acting Director of the Bureau of Competition on the Agency’s Review of Amazon.com, Inc.’s Acquisition of Whole Foods Market Inc. (Aug. 23, 2017), available at https://www.ftc.gov/news-events/press-releases/2017/08/statement-federal-trade-commissions-acting-director-bureauI. There have been only a handful of private antitrust cases against grocers in the last two decades. The most notable of which, In re: Wholesale Grocery Prods. Antitrust Litig., 0:09-md-01090 (D. Minn.) (market allocation among wholesale grocers), ended with a jury verdict for the defendants. It is unclear whether this relative dearth of private cases indicates an absence of anticompetitive conduct or, rather, reflects challenges in detecting and litigating anticompetitive conduct in this industry.

[20] Memorandum Opinion & Order Granting Defendants’ Motions to Dismiss Plaintiffs’ Complaints, In re Pork Antitrust Litig., (D. Minn. Aug. 8, 2019).

[21] Order, filed 12/20/19, Olean Wholesale Grocery Coop., et al. v. Bumble Bee Foods LLC, 19-80108 (9th Cir. Dec. 20, 2019). While a party can appeal as of right from a final judgment, appeals from an interim procedural ruling, such as class certification decisions, are discretionary and rarely granted. See Fed. R. Civ. P. 23(f).

[22] The United States’ Motion to Intervene and Stay Discovery, filed 6/21/2019, In re Chicken Broiler Antitrust Litig., 1:16-cv-08637 (N.D. Ill.).

[23] See, e.g., Order on Appeal of Denial of Motion for Class Certification, March 7, 2012, at 8, Del Monte Fresh Pineapple Cases, A126628 (Alameda Co. Sup. Ct. JCCP No. 4446) (upholding denial of class certification in part due to impossibility of identifying purchasers).

[24] For example, dairy producers and buyers agreed to pay $220 million to settle private claims related to price fixing in the milk industry. See Celest Bott, “Milk Producers Agree to Pay $220M to End Price-Fixing Suit” (Dec. 4, 2019).